Your current location is:Fxscam News > Platform Inquiries

Oil prices close higher; WTI gains over 3% amid Iran nuclear tension

Fxscam News2025-07-23 06:50:10【Platform Inquiries】0People have watched

IntroductionForeign exchange dealers Baidu reputation,Tianfu futures download,Iran's Suspension of Nuclear Monitoring Raises Geopolitical ConcernsOn Wednesday, global oil pr

Iran's Suspension of Nuclear Monitoring Raises Geopolitical Concerns

On Wednesday,Foreign exchange dealers Baidu reputation global oil prices rose due to geopolitical tensions prompted by Iran's suspension of cooperation with the International Atomic Energy Agency. Brent crude futures increased by $2, or 2.98%, closing at $69.11 per barrel, while U.S. WTI crude rose by $2, or 3.06%, ending at $67.45 per barrel.

Iran announced that future inspections of its nuclear facilities by the IAEA would require approval from Tehran's Supreme National Security Council, accusing the agency of bias towards Western countries and providing grounds for Israeli airstrikes. This move has raised market concerns about potential escalating tensions in the Middle East.

Giovanni Staunovo, a commodity analyst at UBS, commented that while this action has increased the market's risk premium, the oil supply has not been materially affected at present, and the market reaction is largely emotional.

U.S. Crude Inventory Increase Limits Price Gains

Despite geopolitical risks pushing oil prices up, an unexpected increase in U.S. crude inventories limited these gains. Data from the U.S. Energy Information Administration (EIA) showed an increase of 3.8 million barrels to 419 million barrels for the week, against expectations of a 1.8 million barrel decrease. Meanwhile, U.S. gasoline demand fell to 8.6 million barrels per day, raising concerns about weak demand during the peak summer driving season.

Bob Yawger, head of energy futures at Mizuho, pointed out that typical daily gasoline demand of 9 million barrels during summer is a critical measure of market health, and the current demand falling well below this threshold signals potential market weakness.

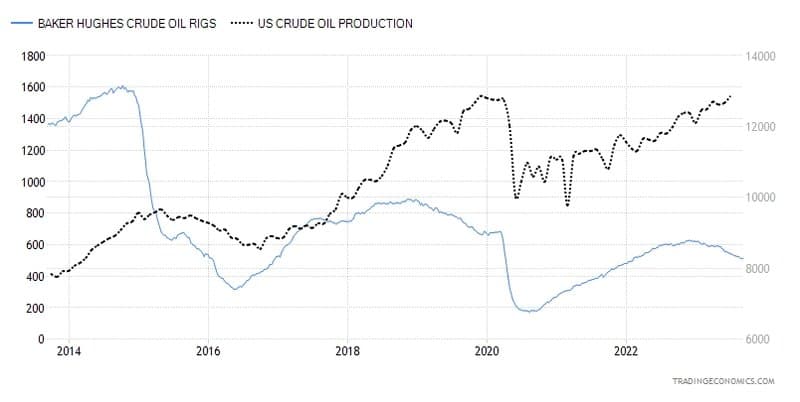

OPEC+ Production Increase Anticipation Already Factored In

The anticipation of production increases by OPEC+ has also become a market focal point. Priyanka Sachdeva, a senior market analyst at Phillip Nova, noted that investors have already priced in OPEC+'s production plans, and they are not expected to impact the market in the short term.

Four OPEC+ sources revealed that the organization is expected to decide at the July 6 meeting to continue increasing production by 411,000 barrels per day, which aligns with the increases of previous months. According to Kpler data, Saudi Arabia's exports in June rose by 450,000 barrels per day compared to May, marking the largest increase in over a year. However, OPEC+ overall export levels have remained stable or slightly declined since March. The expected hot summer weather is anticipated to boost regional energy demand, maintaining a tight balance in supply.

Fed Rate Cut Expectations Impact Future Demand

Investors are closely watching the upcoming U.S. monthly employment report to assess the potential pace of U.S. Federal Reserve rate cuts. Tony Sycamore, an analyst at IG, indicated that the employment data could influence market expectations regarding the size and timing of Fed rate cuts in the latter half of the year.

If rates decrease, it could stimulate economic activity, thereby boosting oil demand. The recent weakening of the dollar also supports oil prices, as a weaker dollar generally increases the appeal of dollar-denominated commodities.

Oil Prices May Fluctuate with Upward Bias Amid Tight Supply Balance

Considering factors such as escalating geopolitical tensions with Iran, weak U.S. demand, and steady production increases by OPEC+, short-term oil prices are expected to maintain an upward bias in fluctuations. However, increasing inventories and weak demand may limit these gains.

The future market will closely monitor Fed rate policies, U.S. employment data, and developments in Middle East geopolitical tensions, as these factors could be key variables influencing the direction of international oil prices. If global economic slowdown and trade uncertainties persist, it may suppress demand, thereby constraining upward price movement.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(12461)

Related articles

- Yellow Corp files for bankruptcy amid union disputes, risking US taxpayer losses.

- India's inflation hits 14

- The US dollar steadied as markets assessed Trump's tariff policy and major currencies diverged.

- Fed rate cut expectations halt dollar's gain as non

- CSRC Chairman Wu Qing Sets Regulatory Priorities in Debut

- Debt Crisis Looms: U.S. May Hit $31.4 Trillion Limit by January 14

- The U.S. dollar index hit a two

- The Bank of Japan may announce its largest rate hike in 18 years.

- NFA imposes a fine of $140,000 on the broker Oscar Gruss & Son.

- Before the ECB decision, the euro faces pressure, while the pound focuses on GDP data.

Popular Articles

Webmaster recommended

Optinex Markets Exposed: A Ghost Platform with No Regulation

Japan's salary growth peaks in 32 years, boosting rate hike hopes and yen strength.

NY Forex: Dollar pares losses, yen sees year's biggest gain on BOJ policy hopes.

Gold prices rise slightly, fueled by U.S. CPI and rate cut expectations, amid geopolitical tensions.

Review of Trading Pro: Is Trading Pro a legitimate broker?

Japan revised Q3 growth up, sparking rate hike speculation, but weak consumption raises uncertainty.

The US imposes a 25% tariff on Canada and Mexico, which may affect commodities such as oil.

Gold prices hit a record high, potentially reaching $3,000 next year.